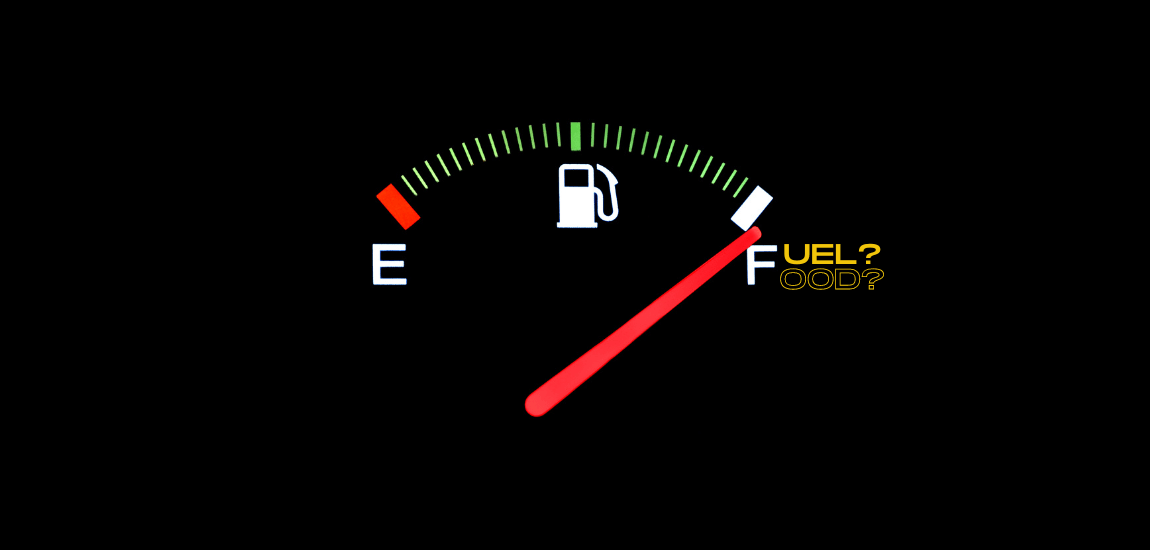

Across the country, people are feeling the pinch at the pumps. Well, let’s get real, when you add the average cost of gas to the ever-climbing cost of everyday goods and services, that pinch can feel more like a stranglehold. [1] But what exactly is behind the staggering cost of gasoline?

Federal Conservative leader Pierre Poilievre continues a cross-country tour to promote his party’s ‘Axe the Tax’ campaign. The campaign is part of a coordinated Conservative media strategy taking aim at carbon pricing, a financial tool implemented by the Liberal government in 2019 to tackle climate change.

While carbon pricing does impact the price of gas, it’s only a small part of the picture.

What is carbon pricing in Canada?

The impacts and costs of climate change are being felt first-hand in communities across Canada. Carbon pricing aims to shift the financial burden of climate change to the heaviest polluters by placing a fee on greenhouse gas emissions and/or offering incentives to reduce emissions. Simply put, the more you pollute — the more you should pay.

Carbon pricing is one of the strongest policy instruments available for tackling climate change. Globally, carbon pricing or emissions trading schemes already cover 30 percent of emissions. [2] Every jurisdiction in Canada has had a price on carbon pollution since 2019. The approach is designed to be flexible; provinces and territories can opt to follow the federal pricing system or design their own pricing systems tailored to local needs. To ensure fairness, the federal government sets a minimum benchmark price that all systems must meet — Ecojustice played a vital role in ensuring that provinces could not opt-out of the national minimum benchmark.

How much is the “carbon tax” per litre of gas in 2024?

As of April 2024, the federal minimum price is set at CA$80 per tonne of CO 2 equivalent. [3] This roughly translates to 14.3 cents per litre of gasoline. Provinces and territories with their own carbon pricing systems can use the proceeds as they see fit. Often the funding supports practical and affordable ways for families to take further action to cut pollution. In jurisdictions where the federal pricing system is in effect, the Government of Canada returns approximately 90 per cent of fuel charge proceeds directly to families through Climate Action Incentive payments.

In jurisdictions where the federal pricing system is in effect, the Government of Canada returns approximately 90 per cent of fuel charge proceeds directly to families through the Canada Carbon Rebate (formally known as Climate Action Incentive payments). The CCR is a quarterly tax-free payment to help eligible individuals and families, with most receiving more than they pay into the federal pollution pricing. The remaining 10 per cent goes to Indigenous communities, farmers, and businesses.

While carbon pricing does have an impact on gas prices, it is far from the main driver of the recent increases we’ve seen. By and large, the price of crude oil has the most impact on the price we pay at the pumps. [4] So, what other factors are behind the sky-high cost of gas?

Big Oil, huge greed

Time and again, Big Oil has shown it can deliver for shareholders but not the planet. In the past few years, oil companies have seen their profits spike alongside gas prices. As the humanitarian crisis began to unfold in Ukraine in 2022, Canadian fossil fuel companies wasted no time trying to turn crisis into cash.

In the span of just one year, the five Big Oil companies — ExxonMobil, Chevron, Shell, BP, and TotalEnergies — more than doubled their profits. Despite commitments to invest in decarbonization and clean energy alternatives, Big Oil’s massive windfalls largely go to stock buybacks, reinvesting in shareholders, and further expansion of fossil fuel exploration and extraction.

The manufactured cost of supply and demand

Fluctuations in crude oil prices are influenced by changes in global supply and demand and current inventory levels. The concept of supply and demand is simple: as demand increases (or supply decreases) the price should go up. As demand decreases (or supply increases) the price should go down. But when it comes to oil prices, it’s not quite so straightforward, thanks to the immense power held by the world’s largest oil producers.

This year, global oil demand is expected to climb by 2.2 million barrels a day to a record 102 million, according to the International Energy Agency. Meanwhile, global oil production is only forecasted to rise by 1.5 million barrels per day to 101.5 million. [5] This supply gap is exacerbated by a pledge made in April by the Organization of the Petroleum Exporting Countries (OPEC), Russia, and other smaller producers to cut production in response to a nearly 39 per cent drop in oil prices from their peak last year.

OPEC is collectively responsible for 30 per cent of global oil production. In June, the organization slashed daily output of crude oil by a further 1 million barrels a day, forcing the price to rise. These costs are only going to climb further as this cut rolls out in other countries in the coming months. Limited storage for refined gasoline poses further pressure on prices.

Global conflict and economic instability

Global economic conditions, geopolitical or military events, and other factors can all have drastic impacts on the price of fuel. That reality was thrown into stark contrast when the Russian invasion of Ukraine in early 2022 sent prices soaring. Russia is the third-largest oil and gas exporter in the world and Ukraine served as a major transit route for Russian gas. Tensions on energy production will only grow as the war escalates. The issue was exacerbated by the mysterious explosions last year that rendered the Nord Stream pipelines inoperable. [6]

Is carbon pricing effective in Canada?

Science is clear: we need to drastically reduce our consumption of oil in the next decade if we are going to avoid the worst impacts of the climate crisis. Already we have witnessed the devastation climate change has wreaked on the environment, human health, and the economy. By 2025, the previous decade of climate change is projected to shave a staggering $25 billion off Canada’s national GDP. [7]

Analysis shows carbon pricing is one of the most effective and affordable options available to tackle climate change. As Canada’s Ecofiscal Commission reported: “[Carbon pricing] delivers the lowest cost emissions reductions. A steadily rising carbon price can achieve Canada’s target and maintain strong economic growth. It can also generate revenue that can be returned to Canadians to maintain affordability.”

We need to take transformative action in the next decade to meet the challenge of climate change. Of course, the case can be made that carbon pricing alone is not sufficiently effective. But the argument given is often disingenuous. Carbon price opponents don’t want to do more to rein in the impacts and costs of climate change — they generally want to do nothing. And that’s something none of us can afford.

From the price at the pumps to Canada’s worst wildfire season on record, Canadians are feeling the impacts of fossil fuel-driven climate change firsthand. Political leaders have the power to put us on a sustainable path by slashing carbon emissions.

References

[1] Monthly average retail prices for gasoline and fuel oil, by geography — Statistics Canada

[2] More Countries Are Pricing Carbon, but Emissions Are Still Too Cheap — IMF Blog

[3] Rebates rise as carbon price increases to $80 per tonne— CBC

[4] Metro Vancouver gas prices soar ahead of Labour Day weekend — CBC

[5] Oil Market Report – July 2023 — International Energy Agency

[6] A global mystery: What’s known about Nord Stream explosions — Associated Press

[7] The GDP costs of climate change for Canada — Climate Institute